year on year to hit new all time records in both condominiums and housing along with record launches and record backlog and that it expects transfers in 2016 to grow by 61% over 2015

Bangkok, 25 February 2016 - Ananda Development Public Company Limited announces another year of record presales in both condominiums and housing resulting in a record backlog and details a business plan for 2016 during which it expects transfers to grow by 61% and announces an increase in the dividend to be paid.

The company announced it had generated 26,235 million Baht in pre-sales for the year, an increase of 26% from 2014, and a new record year for the company. The company set new records for both condominium presales at 22,268 million Baht and housing at 3,967 million Baht

The company ended the year with a backlog of 37.2 billion Baht, another record for the company, and representing an increase of 37% over the 27.1 billion in backlog recorded at the end of 2014.

The company also hit a new record for launches with 34,828 million Baht in new launches made up 31,907 million Baht of condominiums and 2,921 million Baht of condominiums.

Total revenue for the full year of 2015 was 11,025 million Baht, an increase of 4% over the full year of 2014, with 9,598 million Baht revenue from real estate. Profit for the full year was 1,207 million Baht, a decrease of 7% from the profit of 1,301million Baht in 2014 due in part to the costs associated with the record amount of new projects launched through the year.

In the 4th quarter of 2015 the company received 5,426 million Baht in revenue and earned 900 million Baht in net profit. This represents an increase of 28% in revenue compared to the same period of 2014. The company’s net margin in the fourth quarter was 17% compared to a net profit margin of 15% in the fourth quarter of 2014.

Commenting on the level of presales for the year, Mr. Ted Thirapatana, Chief Business Development Officer for Ananda, stated, “By achieving pre-sales growth of 26% for the year we exceeded all our expectations and demonstrated the strong demand for affordable, quality units near mass transit stations and shows the increased recognition by consumers of the value of condominiums located near mass transit stations and the value of the Ananda brand as being the clear leader in the market.”

Mrs. Muntana Aue-Kitkarjorn, CFO of Ananda Development, stated that, “Ananda Development is pleased to have achieved record annual presales in 2015 while maintaining the strong financial discipline that has seen selling costs as a percentage of presales fall by approximately a third in the last two years. This discipline has also resulted in administration costs as a percentage of projects under development also falling by about a third in the same period, which bodes well for future profitability as transfers are expected to increase rapidly as a result of investments made since the IPO while we have successfully controlled costs.”

Mr Chanond Ruangkritya, CEO of Ananda, said, "We are delighted to have achieved record pre-sales for the year despite the economic headwinds and are pleased to have continued our strong discipline in controlling costs. Ananda is not only the leader in Bangkok mass transit living but due to a higher consistent level of sales than any other developer has been the number one seller of condominiums in the whole of Thailand over the last two years.”

He continued, “Despite this explosive growth we have maintained our financial discipline and maintained our net interest bearing debt to equity below our target of 1:1 at the end of the year.”

He added, “As well as the record results the company has made significant additional progress during the year. We expanded our joint ventures with Japan’s largest real estate company, Mitsui Fudosan, with five additional projects announced bringing the total number of joint venture projects to nine with a total development value of 45 billion Baht.”

He continued, “We were very proud to be selected by Samsung to be the first in Thailand to launch their SmartThings Internet of Things SmartHome and we have continued joint research with Samsung to see how these new and rapidly developing technologies can improve the lives of Thai people. We view SmartHome as a strategically disruptive technology that will change the very definition of what it means to be a developer. We have continued deployment of Mitsui’s proprietary Total Quality Production Management System, which we expect to have significant value in improving quality control and we have begun implementing Building Information Modeling software across our entire supply chain, which we expect to significantly improve speed of design and quality control in the future. We have continued with work began after the IPO on upgrading the internal management systems of the company to help manage our rapid growth.”

On the subject of the 2016 Business Plan he explained, “Although our market of mass transit condominiums continues to demonstrate strong demand, we begin the year with a cautious plan due to continuing economic uncertainty, particularly with regard to consumer debts and China, although ready to increase if we see signs of rebound. However, 2016 is the beginning of an exciting period for Ananda as we enter what we refer to as our “Harvest Period”, which will see our transfers almost triple between 2015 and 2018 including a near 40% increase in 2016 to 13.4 billion Baht, including Ananda’s share of joint venture projects. We have backlog to be transferred in 2016 of 10.8 billion Baht, including Mitsui’s share of joint ventures and 8.7 billion Baht including Ananda’s share alone which represents 65% of our annual transfer target. We are finally about to see the investment made after the IPO come through as transfers when we expect to see transfers grow much more rapidly from 2016 onwards as buildings already launched and sold begin to transfer. We have five condominium buildings finishing construction and beginning to transfer in 2016.”

He continued, “Due mainly to our capital investment cycle the launch total will be reduced to around 22 billion in new launches for the year, comprising nine new condominium projects worth 18.7 billion Baht and three new housing projects worth 3.3 billion Baht. Our total presales target for the year is around 21 billion Baht, mostly due to the lower launch total.”

He added, “In 2016 we expect to increase our land purchase budget to 8.7 billion from 5.2 billion in 2015, to support our future growth.”

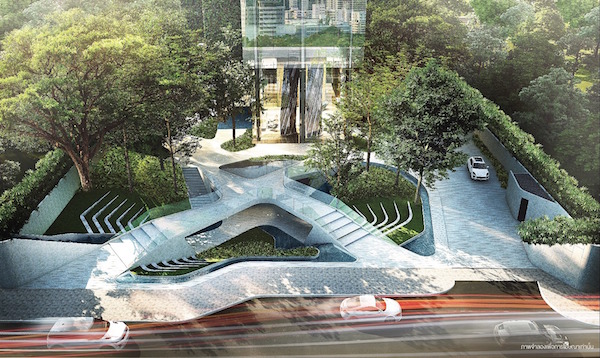

Ashton Silom

He continued, “We plan to do the public launches of two projects that were soft launched in the 4th quarter of 2015 in the first quarter of 2016, Ashton Silom, a luxury high-rise condominium done as a joint venture project between Ananda and Mitsui Fudosan comprising 428 units with a project value of 6,006 million Baht and Ideo Tha Phra Interchange comprising 844 units with a project value of 2,922 million Baht.”

He continued, “Ashton Silom is the first new condominium launched on Silom in more than a decade and the location itself needs no explanation. The building will showcase innovative interlocking floors that increase floor to ceiling heights to 3.6 meters and include four floors of facilities

He added, “Ideo Tha Phra Interchange is located close to the intersections of several lines for blue lines betweenHua Lampong-Bangkae and Bangsue-Tha Phra and thus our slogan for the building of “100 meters to Everywhere”

He concluded, “Our cash flow for the year is strong and as a matter of company policy we maintain a cash balance of at least a billion Baht at all times. We have continued to have strong support from our banks and have multiple options in place to fund the cash needs of the company through the year depending on how the situation evolves.”

As such, the Board will submit for approval to the Annual General Meeting a recommendation to increase the dividend to 10 satang continuing our record of increasing the dividend every year since the IPO.”

Addendum – Data Sheet

Quarterly Results

- Total Revenue: 5,426 million Baht Up 28% from 4,247 million Baht in 4Q2014

- Gross Margin: 37% Down from 40% in 4Q2014

- Interest Expense: 68 million Baht Down from 74 million Baht in 4Q2014

- Tax: 244 million Baht Up from 135 million Baht in 4Q2014

- Net Profit: 900 million Baht Up 39% from 647 million Baht in 4Q2014

- Net Margin: 17% Up from a net margin of 15% in 4Q2014

Full Year Results

- Total Revenue: 11,025 million Baht Up 4% from 10,580 million Baht in 2014

- Gross Margin: 39% Up from 38% in 2014

- Interest Expense: 254 million Baht Up from 227 million Baht in 2014

- Tax: 341 million Baht Up from 294 million Baht in 2014

- Net Profit: 1,207 million Baht Down 7% from 1,301 million Baht in 2014

- Net Margin: 11% Down from a net margin of 12% in 2014

Balance Sheet

- Cash at end of Quarter: 2,573 million Baht Up from 2,477 million Baht in 4Q2014

- Assets: 20,471 million Baht Up from 17,088 million Baht in 4Q2014

- Liabilities 11,744 million Baht Up from 10,175 million Baht in 4Q2014

- Shareholder’s Equity 8,727 million Baht Up from 6,913 million Baht in 4Q2014

- DE Ratio 1.4 times Down from 1.5 times in 4Q2014

- Net IBDE Ratio 0.7 times Stable from 0.7 times in 4Q2014

About Ananda Development PCL

Ananda is a publicly listed real estate development company listed on the Stock Exchange of Thailand (Symbol: ANAN)

The company is the leading developer in Thailand of residential condominium projects within 300 meters of mass transit stations. The company also develops landed housing projects in Bangkok.

Ananda’s primary brands are "IDEO" condominiums, situated within 300 meters of a mass transit station, which are targeted at first home buyers and professionals who value modern design, convenience and ease-of-access when choosing a place to live, and “ELIO” condominiums, situated within 600 meters of a mass transit station, which are aimed at those who want the IDEO lifestyle but at a lower cost.